Recurring FedNow Commissions

What is Recurring FedNow Commissions

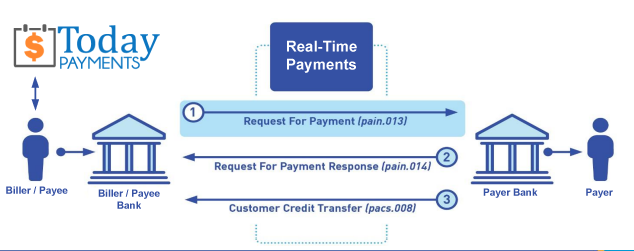

FedNow Commissions and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank, B2B, B2C and C2B account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Recurring FedNow Commissions for your business using Real-Time Payments

Integrating Real-time Payments (RtP) via the FedNow service with QuickBooks Online (QBO) through SecureQBPlugin.com allows businesses to instantly pay commissions to agents using their cell phone numbers or email addresses as "nicknames" or "monikers." Here’s a comprehensive guide to implementing this system:

Implementation Plan

1. Setup SecureQBPlugin.com Integration

- Account Creation: Register and set up an account on SecureQBPlugin.com.

- API Integration: Utilize SecureQBPlugin.com's APIs to integrate with QuickBooks Online (QBO) for seamless data synchronization and payment processing.

2. Configure FedNow Payments with Nicknames

- User Identification: Enable agents to register their cell phone numbers or email addresses as unique identifiers (nicknames/monikers) on SecureQBPlugin.com.

- Link Nicknames to Bank Accounts: Ensure agents can link their nicknames to their bank accounts within the SecureQBPlugin.com platform.

3. Enable Real-Time Payment Requests (RtP)

- Request for Payment (RfP): Implement a system within SecureQBPlugin.com that allows businesses to send RfPs to agents using their registered nicknames.

- Payment Approval: Ensure agents can easily approve payment requests via notifications sent to their cell phone or email.

4. Integration with QuickBooks Online (QBO)

- Sync Payments: Configure SecureQBPlugin.com to automatically record all payments processed via FedNow in QBO.

- Automate 1099 Tracking: Track all commission payments automatically and associate them with the respective agent’s nickname for easy 1099 reporting.

Workflow Example

1. Agent Registration and Setup

- Agent Registration: Agents sign up on SecureQBPlugin.com using their cell phone number or email address as their nickname.

- Bank Account Linking: Agents link their bank accounts to their nicknames on SecureQBPlugin.com.

2. Initiating Payments

- Business Sends RfP: The business sends an RfP to the agent's nickname (cell phone number or email address) through SecureQBPlugin.com.

- Agent Approves Payment: The agent receives a notification on their cell phone or email and approves the payment.

3. Real-Time Payment Processing

- Instant Transfer: Funds are instantly transferred via FedNow from the business’s account to the agent’s account.

- Confirmation: Both the business and the agent receive confirmation of the payment.

4. Automated Accounting in QBO

- Automatic Recording: Payment details are automatically recorded in QBO, updating the business’s accounts payable and the agent’s income records.

- 1099 Reporting: The system tracks all payments to agents, simplifying 1099 generation at the end of the fiscal year.

Benefits

- Efficiency and Speed: Real-time payments ensure agents receive their commissions instantly, improving cash flow.

- Convenience: Using cell phone numbers or email addresses simplifies the payment process for agents.

- Accurate Accounting: Automated synchronization with QBO ensures accurate and up-to-date financial records.

- Regulatory Compliance: Streamlined tracking and reporting facilitate compliance with tax regulations.

Security Considerations

- Data Encryption: Encrypt all sensitive data, such as cell phone numbers, email addresses, and bank details.

- Authentication: Implement robust authentication mechanisms to protect against unauthorized access.

- Fraud Monitoring: Use advanced monitoring tools to detect and prevent fraudulent transactions.

Implementation Steps

- Technical Integration:

- Collaborate with your IT team or a third-party developer to integrate SecureQBPlugin.com with QBO using the provided APIs.

- Ensure the integration supports FedNow and the use of nicknames for payment processing.

- User Training:

- Train your accounting and finance team on using the new system.

- Provide agents with detailed instructions on how to register and link their bank accounts.

- Testing:

- Conduct thorough testing to ensure payments are processed correctly and data is accurately synced with QBO.

- Test the RfP process and payment approval workflow with a small group of agents before full rollout.

- Launch and Support:

- Roll out the system to all agents and provide ongoing support to address any issues.

- Continuously monitor the system for performance and security, making necessary adjustments.

Detailed Workflow

- Agent Registration:

- Agents visit SecureQBPlugin.com and register using their cell phone number or email address.

- During registration, agents link their preferred bank account to their nickname.

- Sending RfP:

- When a commission payment is due, the business initiates an RfP through SecureQBPlugin.com.

- The RfP is sent to the agent’s registered nickname (cell phone number or email).

- Approval and Payment:

- The agent receives a notification via SMS or email and approves the payment.

- Upon approval, FedNow processes the payment instantly, transferring funds to the agent’s linked bank account.

- Accounting Integration:

- SecureQBPlugin.com automatically records the transaction in QBO.

- The system updates the agent's earnings and the business's expense records.

- Reporting and Compliance:

- The integration tracks all payments and facilitates easy 1099 generation.

- Detailed transaction records are maintained for compliance and audit purposes.

By integrating SecureQBPlugin.com with QBO and utilizing FedNow for instant real-time payments using agents' cell phone numbers or email addresses as nicknames, businesses can significantly enhance their payment processes, improve operational efficiency, and increase agent satisfaction.

Creation Request for Payment Bank File

Call us, the .csv and or .xml Real-Time Payments (RTP) or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing